California was the world’s third largest market for solar photovoltaic systems in 2006.

Last year 58 MW were installed. System integrators expect that this market will grow at least by 100% in 2007. The California Solar Initiative (CSI) program, with 3.2 billion dollar government support, could feed an even faster growth in the years to come. What makes California interesting, besides these incentives and the attractive irradiation, is the entrepreneurial climate. Silicon Valley is becoming once again the centre of a booming industry based on silicon. Only this time it is with solar energy and sometimes even without the use of silicon. Dozens of Venture Capitalists, most of them with their roots in software and the internet, have found their way into this renewable industry and funded several startups, with dazzling ambitions, that are ready to provide the global PV market with new generation and lower cost solar technology. Companies like Nanosolar, Miasolé, Applied Materials and Sunpower are likely to play a very important role in the global PV industry.

The Californian PV market

Over the last few years the Californian PV market showed a growth rate of more than 40%. With the new CSI program started in 2007, it seems likely this growth rate will increase this year. Attractive schemes introduced in Germany and Spain have, in the past, resulted in market growth figures of 80-100% per year in the first years. Although the incentives in California are not as attractive as in those two countries, a growth rate higher than 40% seems more than likely. A 'conservative' scenario of 50% year on year growth is likely to result in total sales revenues of more than $800 million for PV systems in 2007, rising up to $2 billion by 2010. A more progressive growth scenario of 80% per year could even lead to sales revenues of $1 billion in 2007 up to $4.7 billion by 2010. In the graph below the ‘conservative scenario’ of 50% per year has been drafted, leading to around 90 MW of new installed power in 2007 up to 300 MW in 2010. In an 80% growth scenario these figures could be 105 MW in 2007 and 620 MW in 2010. There are still some bureaucratic hurdles to be overcome in implementation of the CSI. Therefore the results over the whole of 2007 will provide a better indication for likely growth figures in the coming years. It will be exciting to see whether California can hold its position as the third largest market in the world with the currently exploding Spanish PV market.

International PV trade mission to California

From 10 to 15 June an international PV trade mission will be organized, to learn more about business opportunities in California and to visit the new global PV manufacturers located in the “Solar Silicon Valley” region. The organization is in the hands of SolarPlaza.com, the global PV marketplace, which previously organized similar tours to China, Spain, Italy and Greece. This event will bring together PV business executives and investors from many countries. This creates a dynamic environment and platform for high-level discussions about new business opportunities in the rapidly growing Californian and global solar energy market.

In cooperation with the California Solar Energy Industries Association, a special symposium on 11 June will discuss in detail the implications of the California Solar Initiative (CSI). Major stakeholders will present their views and experiences and discuss business opportunities. The tour will include company visits to the ‘hottest’ PV companies in the USA, like MiaSolé, Applied Materials and Sunpower. In another symposium, relatively young solar technology manufacturers will be in the spotlight among other presentations. SolFocus and Solaria will elaborate on their concentrator techniques, which lead to substantially lower investment costs per Wattpeak. Finally this trade mission will host a matchmaking event for Californian companies and investors with the international delegates, with introductory presentations about the California market potential.

USA in solar spotlight

For several reasons, solar PV in the USA is in the international spotlight.

Firstly of course, there is the 3.2 billion dollar in funding for the next 11 years initiated by Arnold Schwarzenegger. This long term incentive scheme creates a solid ground for new start-ups, and gives the green light for investors and international PV companies.

Secondly, the USA has always been a country with high involvement of venture capital. This business sector has long been searching for new booming industries since the dot-com crisis. The global solar energy market and industry have shown growth figures of over 30% for more than 5 consecutive years. And several relatively young companies have entered the New York stock exchange and collected serious amounts of capital. The timing of the movie and road show by Al Gore couldn’t be better to stimulate the interest of the capital market for solar energy.

The third reason is the growing interest in thin-film technology. The enormous growth of the PV market caused a silicon shortage within the solar industry in recent years. This led to high prices on the spot market, up to 10 times the value this industry always put in their long-term business models. Consequently, the industry enhanced its search for technologies using less silicon, such as thin-film, amorphous silicon cells and modules and CIGS. It stimulated the development of thin-film, non-silicon technologies, like Cadmium Telluride. The world’s largest manufacturer of thin-film CadTel modules is the USA company and NY stock-listed First Solar. The company raised 300 million $ in an IPO last November, grew 300% in production in 2006 and will extend its production capacity with new plants in the USA, Germany and Malaysia to 200 MW.

Venture capital push

The USA has always had a strong position in research and production of thin-film technologies. Thus it is no surprise that the venture capital firms found their way to the start-ups in California working on this, especially those working with alternatives for silicon feedstock. The result of all this is that within a few years several of these start-up companies collected capital to get started and currently are presenting amazing ambitions.

Recently, another issue focused attention on thin-film in the global market. More and more countries are launching feed-in tariff systems to provide incentives for large-scale solar application. Most often the tariff level has been based on experiences with the currently-dominating crystalline module technology. Imagine if you can build multi-megawatt solar power plants in Spain for example, with slightly less efficient thin-film modules that are two or more times cheaper? This would save millions of dollars and push the return on investment way above the current 10%.

Nanosolar, Google and a top-3 position in 2007

Take Nanosolar, founded in 2002 and backed by investors like the founders of Google. Its approach is to develop and produce thin-film solar cells 10 times less costly, focusing on roll-printing of Copper Indium Gallium Selenium (CIGS) technology. This thin-film technology is still playing a minor role in the global PV market. But the guys at Nanosolar have high ambitions. In 2006 they received 75 million dollars of new capital, one of the highest ‘clean technology’ investments that year. Their aim is to realize 430 MW of cell production capacity by 2007 at locations in the USA and Germany. This quantity would have ranked Nanosolar in the top three largest cell manufacturers worldwide in 2006. According to CEO Martin Roscheisen, their technology will deliver cells that cost five times less than conventional crystalline silicon solar cells.

More CIGS technology

Also on the way to deliver cost-effective solar CIGS technology is MiaSolé in Santa Clara, California. The company raised 16 million dollars of investments in 2005, started production in the last quarter of 2006 and aims to have a production capacity of 200 MW by the end of 2007. Unlike crystalline silicon solar cells, CIGS cells can be printed on flexible sheets of foil or other material. According to David Pearce, CEO of MiaSolé, his company will produce both glass-based and flexible modules.

Source: MiaSolé

Underlining the MiaSolé ambitions is that several blog sites published the rumour that they are planning an IPO within 18 months. More recently, completely new companies like Solyndra and Solopower raised 79 and 10 million dollars respectively to fund their CIGS manufacturing plans. Are these companies the only ones working on this technology? No, they are in good company with DayStar Technologies, Global Solar, Honda Motor Company, Würth in Germany and last but not least Shell Solar. It is Shell’s only activity in solar energy after selling their crystalline solar business to the German company Solar World.

Booming business for equipment manufacturer Applied Materials

The dazzling ambitions of the new manufacturers offer beautiful business opportunities for thin-film production equipment manufacturers. The Californian rising star in this field is Applied Materials, a leading semiconductor equipment manufacturer, which has set a target of $500 million for their PV business in 2010. It has already sold several production lines to major existing and new thin-film module manufacturers. Among their customers are the world’s second largest cell manufacturer, Q-Cells, and the newly established company Sunfilm. The latter is backed by investors Good Energies and NorSun AG, both very familiar in the solar industry. The lines will be able to produce the world’s first 5.7m2 tandem thin-film photovoltaic modules on glass substrate. Recently also, the new Spanish module manufacturer T-Solar Global S.A. ordered such a production line. These large modules will be 4 times bigger than today’s largest solar panels. T-Solar rated the production capacity as 40 MW. Applied Materials has found customers all over the world. One of the world’s largest companies in CD-manufacturing, Moser Baer India Ltd., selected Applied Materials to supply a similar production line of 40 MW capacity. With their extensive experience in high volume manufacturing, Moser Baer India expects it can drive down the cost for modules substantially. Applied Materials expects it will be able to produce equipment for CIGS-technology in the near future, which could bring them more customers closer to their base.

Only winners

Are only start-ups looking at thin-film technology? Absolutely not. The major brands in the market like Q-cells, Suntech Power, Sharp, etc, have all initiated research and production initiatives in the thin-film technology area.

Is the recent growth of thin-film technology an unexpected phenomenon?

Not really. More than a decade ago, top researchers and scientists predicted that, whatever will be done to make crystalline silicon solar cells cheaper, such as increasing production volumes and improving efficiency, it will never reach the low-cost production level possible with fully automated production using thin-film technologies. The obvious reasons lie in the level of automation, energy and feed-stock needed. The industry focuses on bringing the cost down in order to achieve “grid parity” for end users, with the production cost of a solar kWh being equal to current market prices on the grid. Such a market will no longer be dependent on government support. Then the market potential will be beyond imagination. Some experts believe “grid parity” in certain market segments can be reached within 5 years. A challengingly short period for such a dynamic industry.

Will all of this mean the end of crystalline silicon technology? Certainly not. At the moment, more than 90% of all solar modules sold worldwide are based on this still developing and dominant technology. Efficiencies are constantly improved, the global production scale and (research) infrastructure is enormous. This technology is preferred for several applications and the price of solar-grade silicon is likely to drop next year due to massive new investments by the industry.

Look at the unprecedented growth of SunPower Corporation, realizing a three-fold increase in their revenues for 2006, up to $236.5 million from $78.7 million in 2005. SunPower is famous for its high-efficiency back-contact crystalline silicon solar cells with an efficiency currently rated at 22%. The cells and modules have a uniquely attractive, all-black appearance and the efficiency is the highest commercially available in the global market. Sunpower will expand its production capacity to 207 MW in 2008, almost double the size of 2007. SunPower took over PowerLight last year, a leading global provider of large-scale solar power systems, with over 100 megawatts installed, which will give a poll position in the growing Californian PV market.

With the above observations, it can be concluded that the USA is on its way back to the frontline of the global PV industry and market developments. With new upcoming markets not only in California, but also in other US states and countries like Spain, Italy and Greece, a further growth of the global PV market of at least 30% per year for the coming years seems likely, with next-generation solar technologies and an expected rapidly growing domestic market. This will create room for a range of (new) technologies and new companies, creating winners and no losers. Only some winners will win a little bit more.

Source: SolarPlaza.com

Le ministère fédéral de l'économie et de la technologie (BMWi) a lancé le 30 avril 2007 un concours de l'innovation technologique intitulé 'E-Energy : systèmes énergétiques du futur basés sur les nouvelles technologies de l'information et de la communication (NTIC)'.

Le ministère fédéral de l'économie et de la technologie (BMWi) a lancé le 30 avril 2007 un concours de l'innovation technologique intitulé 'E-Energy : systèmes énergétiques du futur basés sur les nouvelles technologies de l'information et de la communication (NTIC)'. La compagnie française GUAL Industrie, a mise au point un concept révolutionnaire d'éolienne à axe vertical appelé « StatoEolien ».

La compagnie française GUAL Industrie, a mise au point un concept révolutionnaire d'éolienne à axe vertical appelé « StatoEolien ».  Dans le cadre d'une signature ou d'un renouvellement de contrat de location, pour des bâtiments existants, le contenu du diagnostic de performance énergétique devra également y figurer.

Dans le cadre d'une signature ou d'un renouvellement de contrat de location, pour des bâtiments existants, le contenu du diagnostic de performance énergétique devra également y figurer. Une méthode biologique de dégradation de bois a été développée par un groupe de chercheurs, universitaires et industriels, dans le but de produire du bioéthanol.

Une méthode biologique de dégradation de bois a été développée par un groupe de chercheurs, universitaires et industriels, dans le but de produire du bioéthanol. Le Laboratoire National d'Aérospatial (NLR) a mené des recherches sur la baisse du niveau sonore des éoliennes dans le cadre du projet européen Sirocco (Silent Rotors by Acoustic Optimisation).

Le Laboratoire National d'Aérospatial (NLR) a mené des recherches sur la baisse du niveau sonore des éoliennes dans le cadre du projet européen Sirocco (Silent Rotors by Acoustic Optimisation).

La construction de la plus grande centrale électrique solaire au monde, qui couvrira une surface équivalente à 200 terrains de football et produira 40 millions de kilowatts par an, a commencé lundi à Brandis, ont annoncé les autorités de l'Etat régional de Saxe.

La construction de la plus grande centrale électrique solaire au monde, qui couvrira une surface équivalente à 200 terrains de football et produira 40 millions de kilowatts par an, a commencé lundi à Brandis, ont annoncé les autorités de l'Etat régional de Saxe. Les batteries des téléphones et ordinateurs portables, radios et autres appareils électriques pourront bientôt être rechargées à l'énergie solaire.

Les batteries des téléphones et ordinateurs portables, radios et autres appareils électriques pourront bientôt être rechargées à l'énergie solaire.  Showa Shell Sekiyu KK va commercialiser à partir de mai des cellules pour panneaux solaires à base de CIS. Le CIS (de l'anglais Copper Indium di-Selenide) est un semi-conducteur capable de se substituer au silicium des cellules photovoltaïques habituelles tout en étant beaucoup plus simple à fabriquer. Leur rendement de 10% est légèrement inférieur à celui des cellules en silicium poly-cristallin et le prix de vente des panneaux solaires avoisinera celui des panneaux poly-cristallins.

Showa Shell Sekiyu KK va commercialiser à partir de mai des cellules pour panneaux solaires à base de CIS. Le CIS (de l'anglais Copper Indium di-Selenide) est un semi-conducteur capable de se substituer au silicium des cellules photovoltaïques habituelles tout en étant beaucoup plus simple à fabriquer. Leur rendement de 10% est légèrement inférieur à celui des cellules en silicium poly-cristallin et le prix de vente des panneaux solaires avoisinera celui des panneaux poly-cristallins. Hier, le gouvernement du Canada a annoncé l'interdiction de la vente d'ampoules inefficaces, dans tout le pays, à compter de 2012.

Hier, le gouvernement du Canada a annoncé l'interdiction de la vente d'ampoules inefficaces, dans tout le pays, à compter de 2012.  Hélion, filiale d'Areva spécialisée dans les solutions énergétiques à base d'hydrogène et de piles à combustible, a livré au Commissariat à l'Energie Atomique de Saclay (Essonne) un prototype de pile à combustible à usage statique.

Hélion, filiale d'Areva spécialisée dans les solutions énergétiques à base d'hydrogène et de piles à combustible, a livré au Commissariat à l'Energie Atomique de Saclay (Essonne) un prototype de pile à combustible à usage statique.  Cette initiative cherche à rapprocher ce type d'installation des consommateurs, afin de garantir le développement de l'énergie solaire.

Cette initiative cherche à rapprocher ce type d'installation des consommateurs, afin de garantir le développement de l'énergie solaire. Sasol Technology et Avantium Technologies ont annoncé un accord de collaboration de recherche stratégique dans les domaines de la chimie Fischer-Tropsch, visant à convertir le charbon et le gaz naturel en carburants liquides.

Sasol Technology et Avantium Technologies ont annoncé un accord de collaboration de recherche stratégique dans les domaines de la chimie Fischer-Tropsch, visant à convertir le charbon et le gaz naturel en carburants liquides.  Un projet solaire thermique allemand de démonstration utilisant des collecteurs de Fresnel est en train de voir le jour sur la 'Plataforma Solar de Almeria' dans le sud de l'Espagne.

Un projet solaire thermique allemand de démonstration utilisant des collecteurs de Fresnel est en train de voir le jour sur la 'Plataforma Solar de Almeria' dans le sud de l'Espagne. Soutenu par tous les acteurs de la filière nationale et régionale, le

Soutenu par tous les acteurs de la filière nationale et régionale, le

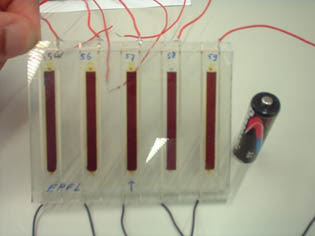

Les universités de Bath, Bangor et Swansea, Imperial College London (ICL) et l'entreprise métallurgique Corus Colors collaborent depuis peu sur un projet de trois ans co-financé par le gouvernement ayant pour objectif la conception d'un revêtement à cellules solaires nanocristallines à colorant, utilisable sur les toits en acier des entrepôts et supermarchés. Ce produit devrait se présenter sous forme d'un revêtement sérigraphié ou de spray. L'avantage des cellules solaires semi-conductrices à colorant (DSSCs pour Dye-Sensitised Semi-conductor Cells) sur les cellules solaires en silicium est leur bon rendement sur une plage d'intensité lumineuse variable.

Les universités de Bath, Bangor et Swansea, Imperial College London (ICL) et l'entreprise métallurgique Corus Colors collaborent depuis peu sur un projet de trois ans co-financé par le gouvernement ayant pour objectif la conception d'un revêtement à cellules solaires nanocristallines à colorant, utilisable sur les toits en acier des entrepôts et supermarchés. Ce produit devrait se présenter sous forme d'un revêtement sérigraphié ou de spray. L'avantage des cellules solaires semi-conductrices à colorant (DSSCs pour Dye-Sensitised Semi-conductor Cells) sur les cellules solaires en silicium est leur bon rendement sur une plage d'intensité lumineuse variable.